Advanced Bankroll Management Strategies for Crypto Poker Players

5 min read

Let’s be honest. The rush of playing poker with Bitcoin or Ethereum is something else. The speed, the anonymity, the global tables… it’s intoxicating. But that volatility? It’s a double-edged sword. Your stack isn’t just chips—it’s a digital asset that can swing 20% in a day. Traditional “buy-in” rules feel suddenly… inadequate.

That’s where advanced bankroll management for cryptocurrency poker comes in. It’s not just about surviving downswings. It’s about building a resilient, growing portfolio where your poker skill and your asset strategy work in tandem. Let’s dive into the frameworks that separate the reckless degens from the strategic pros.

Why Crypto Bankroll Management is a Different Beast

You wouldn’t use a fishing net to carry water. So why use a fiat-based bankroll plan for crypto? The old rules break down fast here. Your bankroll’s fiat-equivalent value is in constant flux. A 10-buy-in downswing in crypto terms could be a 15-buy-in hit in USD if the market tanks simultaneously. That’s the unique risk—and opportunity—you’re managing.

The Core Mindset Shift: You’re an Asset Manager

First, reframe your thinking. You’re not just a poker player. You’re a digital asset manager who uses poker as one vehicle for growth. Your bankroll is a portfolio. This subtle shift changes everything. It moves you from “How much can I bet?” to “How is my capital best allocated?”

Strategy #1: The Dual-Ledger Accounting System

This is non-negotiable. You must track two values simultaneously:

- Cryptocurrency Units (e.g., BTC, ETH): Your actual coin count. Did you win 0.05 BTC? That’s a pure win, regardless of price.

- Fiat-Equivalent Value (e.g., USD, EUR): The purchasing power of your stash. This determines your real-world buying power and risk levels.

Here’s a simple table to visualize tracking a session:

| Session | Crypto Start | Crypto End | Unit +/- | Fiat Value @ End |

| April 10 | 1.25 BTC | 1.29 BTC | +0.04 BTC | $85,000 |

| April 11 | 1.29 BTC | 1.27 BTC | -0.02 BTC | $78,000 (market drop) |

See the story? Session two was a loss in BTC, but the fiat value dropped more due to a market crash. That dual view stops you from misreading a market pump as poker skill.

Strategy #2: Dynamic Buy-In Sizing Based on Volatility

The classic 100-buy-in rule for cash games? It needs a volatility multiplier. In highly volatile altcoin seasons, you might need 150, even 200 buy-ins. During stable periods in blue-chips like Bitcoin, 100 could suffice.

Here’s a practical method. Calculate your Volatility-Adjusted Buy-In (VABI):

- Check the 30-day historical volatility of your crypto asset (many exchanges show this).

- If volatility is 20% above the long-term average for that asset, increase your required buy-ins by 25%.

- If volatility is unusually low, you can—maybe—shave off 10%. But err on the side of caution. Always.

This isn’t about perfection. It’s about dynamically adjusting your shock absorbers for the road you’re on.

Strategy #3: The Tiered Allocation Model

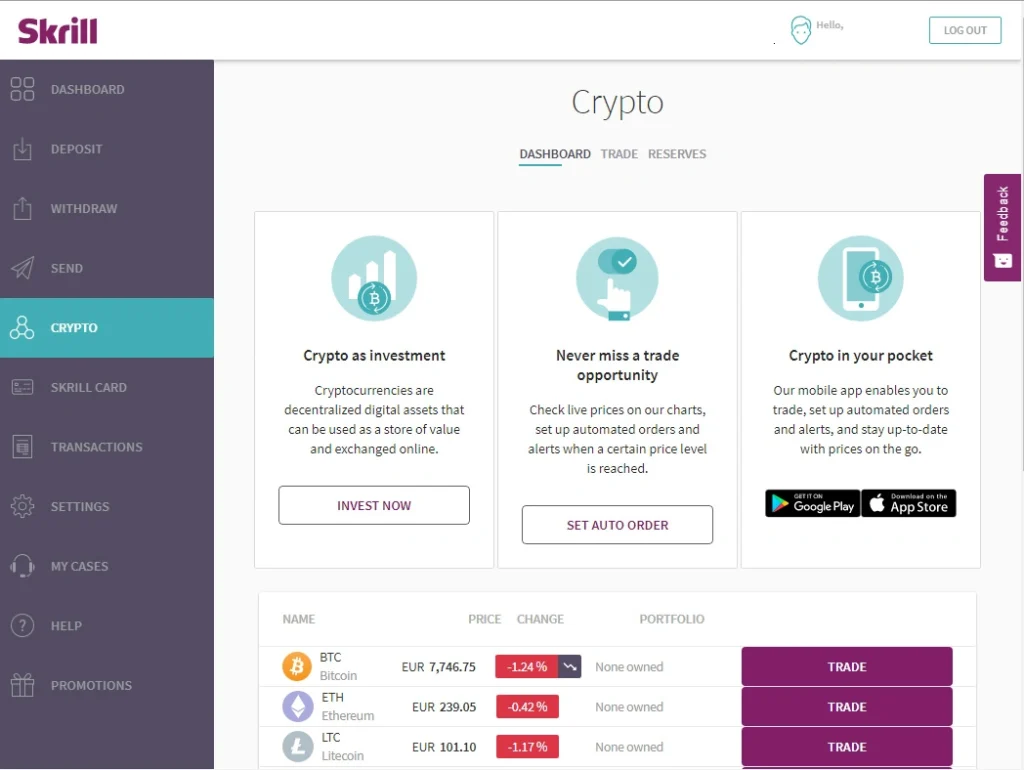

Don’t keep your entire net worth on a poker site. That’s just asking for trouble—platform risk is real. Instead, segment your overall crypto holdings like this:

- Cold Storage (60%): Long-term holds. Offline. Not touchable for poker.

- Poker Bankroll (25%): Dedicated funds on your chosen poker site(s).

- Liquid Buffer (15%): In your personal wallet, ready to replenish the poker roll or take advantage of a market dip.

This model protects you from impulsive, “I’ll just dip into my savings” decisions during a brutal downswing. The poker bankroll is its own entity. When it’s gone, you stop. You recharge from the buffer deliberately, not emotionally.

Strategy #4: Hedging Your Stakes (Not Just Your Bets)

This is next-level. If your poker bankroll is primarily in Ethereum, but you’re worried about a short-term network downturn, consider this: play on sites that offer stablecoin tables (like USDT).

You’re effectively hedging your asset risk while you play. Win in stablecoins, then convert back to your preferred asset on your terms. It adds a step, sure, but it decouples your poker results from market swings, letting you focus purely on equity and odds.

The Rebalancing Trigger

Set predefined rules for moving profits. For instance: “Any time my poker bankroll exceeds 120% of its target size in fiat value, I withdraw 50% of the excess to cold storage.” This systematically harvests wins and compounds your safety net.

The Psychological Game: Playing Through the Pump and Dump

Honestly, this might be the toughest part. Your bankroll in USD terms doubles because of a bull run. You feel richer. The temptation to move up in stakes prematurely is enormous. That’s the siren song.

Stick to your unit count. If you started with 1 BTC playing $1/$2, and now that 1 BTC is worth twice as much, you’re still a $1/$2 player in BTC terms. Moving up should be a function of your skill and your crypto unit growth, not market euphoria. The reverse is true in a bear market—don’t panic and overstep just because your fiat value shrank.

Putting It All Together: A Fluid, Not Fixed, System

Look, these advanced bankroll management strategies aren’t a rigid checklist. They’re interlocking principles. You track dual ledgers. You adjust buy-ins for market mood. You allocate in tiers, and you hedge when the winds shift.

The end goal isn’t just to survive at the tables. It’s to build a financial position where a market crash doesn’t cripple your game, and a poker downswing doesn’t force you to sell your crypto at a loss. You achieve a kind of… equilibrium. Where your decisions are dictated by logic, not by the frantic charts on your second screen.

In the end, mastery here is quiet. It’s the peace of mind knowing your foundation is built for both poker variance and crypto volatility. And that, in this wild hybrid arena, is the ultimate edge.